How Small is "Small" ?

Updated in June 2022, and again in September 2023:

This “Thought” was first published in September 2019. It has been updated in response to the NCVO’s consultation on establishing a “Small Charities Advisory Panel” to “….ensure that the wider offer for small charities across the sector – from other infrastructure bodies, policymakers and funders – is comprehensive, responsive and coherent, and that the voices of small charities continue to be heard and amplified.”

Referring to charities as "small charities” begs the question: “How small is small? "

"Small" is a comparative adjective. Smaller than what?

If you said of a person, or a car, or a box of chocolates, or anything - that they were "small", what would that mean?

In everyday speech that would mean that they were smaller than the norm, the typical, the average, ie: they were smaller than expected for that kind of thing.

A search of the internet for "What is a 'small' charity" most commonly returns the answer "One with an annual income of less then £1M".

A search of the internet for "What is a 'small' charity" most commonly returns the answer "One with an annual income of less then £1M".

But, a search of the Charity Commission's Register of Charities typically shows that 95% of the ca.142,000 registered charities have incomes of less than £1M (and that ca.142,000 excludes the ca.27,000 - 16% of all charities- which have incomes of less than £100, presumably because they are either inactive or are registered recently and so have not yet submitted their first annual return).

People who are 5'10" (1.78m) aren't "small" just because there are a few people who are taller than 7' (2.13m)

People who are 5'10" (1.78m) aren't "small" just because there are a few people who are taller than 7' (2.13m)

So the 95% of charities which have incomes less than £1M are NOT "small" just because there are 5% of charities with income more than £1M. They are just "ordinary" - they are the norm. They should NOT be called "small charities" at all - they are just "charities" - the normal every-day standard-sized charity.

If we divided all the 142,000 charities into two equal-sized groups, based on their annual income, and called them "smaller" and "larger" charities:

# the ca.71,000 “smaller" charities would have incomes in the range £100 to ca.£21,000 (not £1,000,000 !);

# and the other ca.71,000 "larger charities" would have incomes in the range £21,000 to £1,000,000,000.

And if we divided all the 142,000 charities into three equal-sized groups and called them "smaller", "medium" and "larger" charities:

# the 48,000 "smaller charities" would have incomes in the range £100 to ca.£8,000

# the 47,000 "medium charities" would have incomes in the range ca.£8,000 to ca.£55,000

# And the remaining 47,000 "larger charities" would have incomes in the range ca.£55,000 to £1,000,000,000

One might be tempted to say that they could be called "poor charities", "normal charities" and "wealthy charities", but that might be a step too far.

But it does illustrate a rather more subtle, and therefore less obvious, point about the common use of terms like "small charities" to describe what are actually "normal" charities. "Small" is often used as a diminutive - ie: carries with it the pejorative implication of being "less good than...", or "inferior to...", the norm.

In the charity sector, that diminutive approach can be seen in the way that much of the rules, guidance & support tends to be focused on the running of the minority of "larger" charities - ie: those wealthy enough to be able to employ the professional staff and advisors needed to implement those rules & guidance.

In the charity sector, that diminutive approach can be seen in the way that much of the rules, guidance & support tends to be focused on the running of the minority of "larger" charities - ie: those wealthy enough to be able to employ the professional staff and advisors needed to implement those rules & guidance.

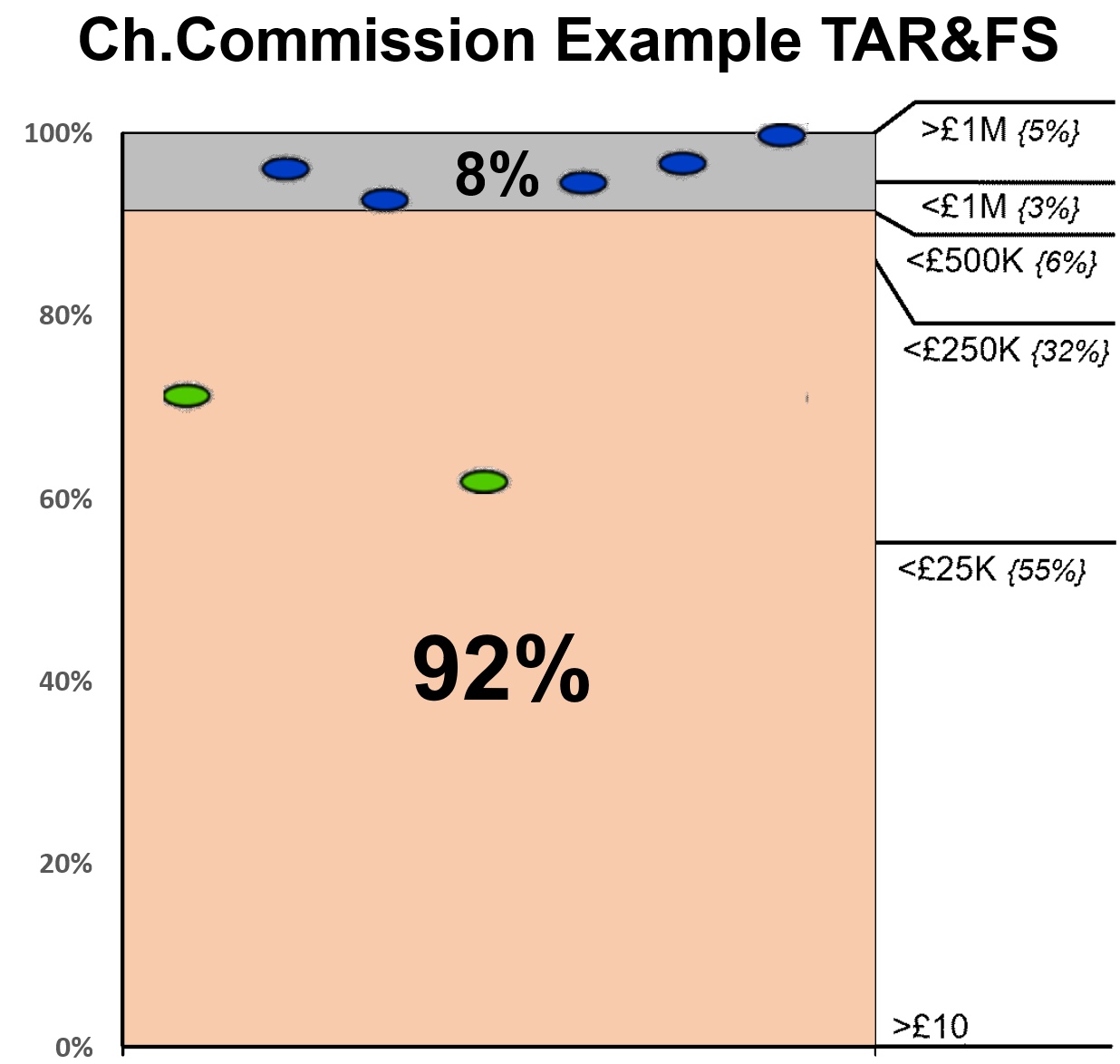

This problem is well illustrated by the Charity Commission's examples of Trustees Annual Reports & Accounts.

Of the 7 examples, the majority (5 = 71%) are for the 8% minority of "wealthy" charities with annual incomes over £500,000.

But only 2 are for the substantial majority (92%) of "lower-income" (and, therefore, of "lower-importance"?) charities.

And the problems created by a diminutive approach to "small" charities are particularly obvious and severe in the financial reporting guidance and regulations for "small" charities and the "concession" which allows "lower income" charities to opt to produce their financial reports on a "Cash" (Receipts & Payments) basis instead of an Accruals basis (provided that they are not charitable companies). Those issues are dealt with in some separate "Charity Thoughts" and guidance leaflets, eg: "Not Fit for Purpose" and "To Accrue or Not To Accrue".

Small Charity Support now takes a different approach to describing what it sees as "small" charities, and defines them pragmatically as:.

"primarily run 'hands-on' by their un-paid non-accountant trustees and other volunteers in their spare time - usually with minimal or no paid professional administrative and/or financial support staff".

ie: its focus is on providing support which is pragmatic and relevant to the needs and issues faced by such charities (which are, usually, in the 75% majority of "ordinary" charities with incomes less than ca.£100,000).

And often wonders if its name should be changed to just "Charity Support"?

More importantly What is really needed is a major change in the "gold standards" for management, governance and reporting in the charity sector.

What is really needed is a major change in the "gold standards" for management, governance and reporting in the charity sector.

Instead of being focused on the needs of the small minority of "wealthy" charities run by teams of full time employed professional management staff, they should be focused on the needs of the majority of "small" and "medium" charities run by groups of unpaid volunteer non-accountant/lawyer trustees in their spare time, perhaps assisted by other volunteers or junior administration staff.

ie: the charity sector's "gold standards" should be explicitly designed to meet efficiently, effectively and economically (and ethically and equitably) the needs of the majority of "small" & "medium" charities.

Any additional standards to meet the needs of the minority of wealthy charities should be extensions or alternatives to those "gold standards". ie: the volunteer trustees of small and medium charities should no longer be made to struggle trying to knock the "square pegs" of the financial management of their "small" charities into the "round holes" of commercial financial standards - as it is at present.

Or as Caron Bradshaw, CEO of the Charity Finance Group, is reported as saying: "...we need to break this long but flawed habit of shoehorning charities into regulation and legislation designed for the for-profit world to avoid the unintended and harmful consequences such an approach brings about for the third sector."